Apr 2024

Apr 2024

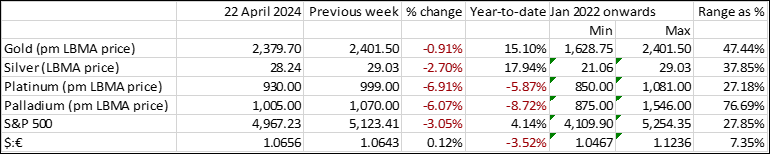

Weekly roundup for StoneX Bullion

By Rhona O'Connell, Head of Market Analysis

- Recalibrating in the higher ranges, fuelled by large-scale private investment

- Regional variations have emerged with Asia adjusting to the new price level…

- … while the western hemisphere coin and bar demand is struggling

- Diplomatic efforts persist in the Middle East

- While the Fed adheres to higher for longer

- CFTC figures show some caution creeping in in the week to 16th April, but this is a natural market reaction

Outlook; it looks as if the price-elastic markets in the Middle and Far East are adapting relatively quickly to the change in range; this should prove supportive even if (hopefully) geopolitical tensions can ease. Technicals are turning lower for gold and silver so some further retreat may be on the cards. Gold support $2,300 and $2,200; silver $27.00, -25.30

Gold, year-to-date; technical

Source: Bloomberg, StoneX

Still in its uptrend but over-extended and the The MACD (Moving Average Convergence/Divergence generated a sell signal at the end of last week. This is a popular technical measure and could well indicate further slippage in spot prices.

Key drivers last week were again geopolitics and central bank policy. The Fed moved closer to centre stage once more, with Fed Chair Jay Powell giving an important midweek address. He naturally addressed both elements of the Fed’s Dual Mandate:

- The labour market; continued strength with the ratio of openings to unemployed workers now down to just a shade above pre-pandemic era

- Surveys of intentions plus the rates of quits and hires all point to a stabilising market and broader wage pressures continue to moderate, gradually

That said, the NFIB (National Federation of Independent Business, the US association for small businesses) is more bearish, with its March Optimism index down 90 basis points to 88.5, the lowest since December 2012. This could well be significant since when it comes to inflation, one of the things Mr. Powell said was “… we have plenty of space to ease should the labour market unexpectedly weaken”.

On inflation itself he noted that the Core Personal Consumption Expenditure index, which is one of their most closely-watched parameters, is estimated to be little changed between February and March at 2.8% and the 3- and 6-month measures are above that level.

The Fed needs more confidence in the trends before it will be ready to move and he was clearly signalling that Higher for Longer is the watchword – apart from the above caveat about any unexpected weakness in employment.

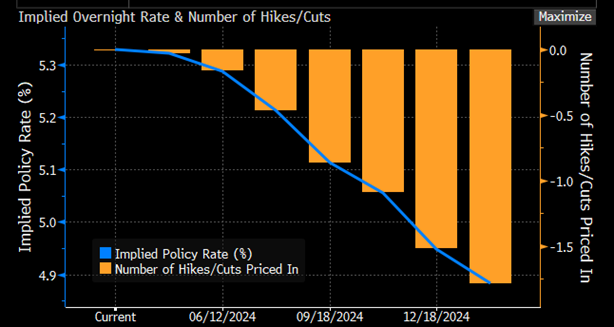

So now we wait to see how it pans out. If the NFIB confidence (or rather, lack of) trend continues then the Fed’s stance may ease. But for now it looks as if it will be a good while before any rate cut. We would expect no earlier than September - if then.

Given the way the debate has panned out over the past few months, the impact of these comments is largely neutral for gold and is likely to remain so. The boost has been delivered, not least from large-scale private investors and sustained demand from the official sector (which, as well as providing physical support, sends a signal to the rest of the world about the desire for stability and the use of gold accordingly). Now the market is recalibrating and physical markets in the East, at least, are adapting to higher ranges.

Bond markets expectations for the rate cycle; 40% chance of a cut in September and a 40% chance of a further cut in December

Source: Bloomberg

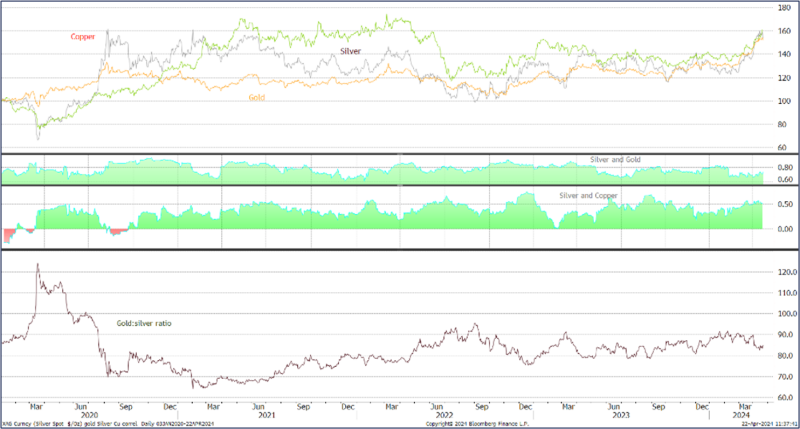

Meanwhile silver demand has picked up smartly in India and premia in Shanghai are consistently more than 10% over loco London, suggesting continued demand there also. The persistent slack in the property market in China, and the need for the Government to keep the yuan steady in the face of US interest rate policy, means that there is not much room for manoeuvre and bank rates are being held steady accordingly. This conundrum potentially means that consumer confidence in China will remain impaired for now and this bodes well for gold and potentially silver purchases also.

Silver, year-to-date; technical

Source: Bloomberg, StoneX

The technical construction on the silver chart is also weakening, with spot now trading below the 10‑day moving average (which is at $28.24 as we write). The MACD is in the process of generating a sell signal here, also.

The gold and silver exchange traded funds have continued to encounter redemptions in the past week. Gold has seen some light buying interest but the sellers still have the upper hand, especailly on the approach to $2,400 towards the end of the week. Net sales so far this month are ~28t, for a year-to-date fall of 140t (world mine production is roughly 3,700tpa).

Silver has been under continued profit taking, which is relatively unusual as silver ETF holders are dominated by the retail sector and tend to be long-term invesmtents; the32% rise from end-February to the recent peak of $29.80 (12th April) has obviously been too tempting to resist and silver has lost 989t since 10th April. At the highs just two days of redemptions amounted to 259t combined. For the year-to-date, changes have now swung into a net loss of 133t (global mine production is ~26,000tpa).

Gold, silver and copper; silver correlation with gold, 0.72; with copper, 0.402

Source: Bloomberg, StoneX

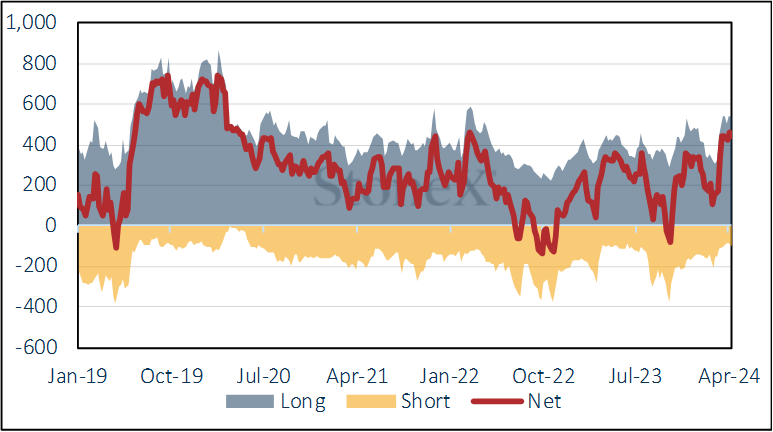

The Commitments of Traders report for 16th April, when gold had peaked at $2,435 on the 12th and eased to $2,383 for a net gain on the week of $54, saw a small increase of just five tonnes in the outright long, while shorts expanded by 27% to 102t from 81t. This took the net long to 441t, down from 457t the previous week . The outright long, at 543t, is 33% over the 12-month average of 407t.

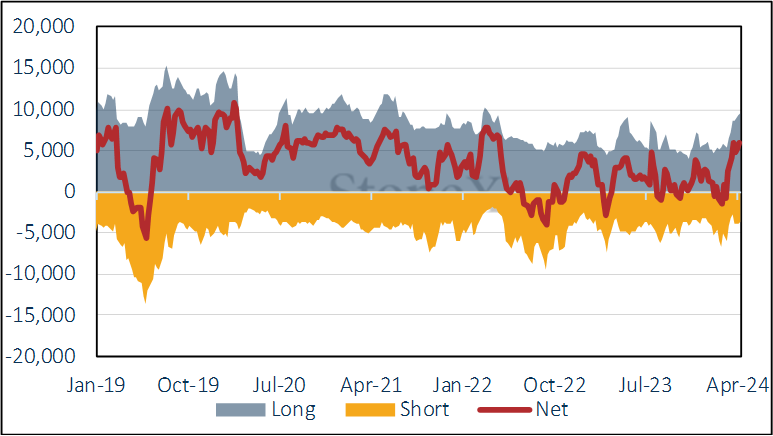

Silver was similar. Spot topped out on the 12th and at close of business on 16th was $28.11, not much higher than the previous week’s opening of $27.85 Longs rose by 3% or 280t and shorts expanded by 7% to 3,693t. This leaves a net long of 5,890t with the outright longs still looking too toppy at 9,582t, 55% over the 12-month average.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

Source: Bloomberg, StoneX